High Approval Payday Loans Explained

n Yes, single mothers have numerous alternate options to payday loans, together with personal loans from credit score unions, group help applications, and even crowdfunding. Better monetary planning and accessing local sources can offer wanted aid without the risks related to payday lo

Understanding excessive approval payday loans is important for these facing monetary emergencies. These loans present fast entry to cash, particularly when traditional banking routes are inaccessible. Many lenders provide straightforward approval processes and instant funding, which can help bridge the hole until your subsequent paycheck arrives. This article will delve into how excessive approval payday loans work, their benefits and risks, and provide insights into reliable sources like BePick, a platform devoted to reviewing these mortgage options comprehensiv

Managing Online Loans Effectively

Once you’ve got secured an internet loan, efficient management is crucial for monetary well being. Setting a price range can help make positive that mortgage repayments fit within your general monetary plan. It’s crucial to prioritize well timed funds to avoid penalties and negative impacts in your credit rat

Moreover, many online lenders operate with minimal oversight, which can result in much less favorable No Document Loan phrases or insufficient customer help. It’s essential for debtors to thoroughly vet potential lenders and contemplate their reputation before proceeding with an applicat

Many lenders concentrate on the borrower’s income somewhat than their credit score score, which allows excessive approval rates. This method is beneficial for individuals with poor credit histories or these new to credit, making it a well-liked alternative during financial emergenc

BePick: Your Guide to High Approval Payday Loans

BePick is a superb useful resource for anyone considering high approval payday loans. The web site provides detailed evaluations of varied lenders, allowing users to check rates, phrases, and buyer experiences side-by-side. By utilizing BePick, borrowers can gain perception into one of the best lenders available in the market, aiding them in making clever financial choi

Understanding Payday Loans

Payday loans are short-term loans designed to bridge the hole between paychecks. Typically, these loans are for small quantities and are supposed to be repaid on the borrower’s next payday. While payday loans can provide quick money aid, they usually include high interest rates and exorbitant charges. This makes them a fragile resolution for single mothers, who may already be struggling with tight budgets. It’s essential to totally perceive how these loans work to avoid falling into a cycle of d

The absence of credit score checks could sound appealing, nevertheless it’s important to recognize that lenders often use different strategies to evaluate threat, such as employment historical past, income ranges, and financial institution statements. This can lead to higher interest rates and fewer favorable terms in comparability with conventional lo

Once a good lender is recognized, candidates can sometimes fill out a web-based kind detailing their private colal.us and monetary information. This might embrace proof of income and checking account details. Approval typically happens inside minutes, and funds may be deposited into the borrower’s account throughout the same

To maximize the benefits from money flow assistance loans, companies should comply with some finest practices. Effective budgeting is vital, permitting companies to plan for loan repayments and avoid further financial strain. Setting aside a part of the money inflow from the loan for compensation can safeguard towards cash flow difficulties down the r

Lastly, keep in mind that borrowing should be a final resort. If attainable, contemplate different solutions such as borrowing from family or pals, negotiating with collectors, or in search of financial assistance packages that may supply higher phra

Moreover, some lenders offer flexible repayment options. Some loans could permit for extensions or fee plans, giving borrowers more time to settle their debts with out incurring further penalties. This consideration can make high approval payday loans a viable choice for those in n

An Additional Loan advantage is the accessibility that these loans present for individuals who have been turned down by conventional banks or credit unions as a outcome of poor credit scores. This inclusivity can provide a possibility to manage sudden bi

Moreover, these loans contribute positively to an organization’s credit score historical past when managed accurately. By borrowing responsibly and ensuring well timed repayments, businesses can improve their borrowing capacity in the future. This units a powerful foundation for sustainable development and operational stabil

Additionally, businesses ought to contemplate the compensation phrases. Some loans might have shorter compensation periods, while others offer extended phrases which might help ease monthly cash move. Identifying a repayment structure aligned with the business’s cash flow cycles can enhance monetary stabil

Finding Online Loans for Fair Credit

The Application Process

Applying for an internet mortgage with honest credit usually involves several key steps. First, gather essential documentation corresponding to proof of revenue, identification, and probably your credit score report. Many lenders may require this stuff to evaluate your application and provide one of the best rates and phra

Where to Find Reliable Information

In the panorama of unfavorable credit ratings loans, dependable data is paramount. Websites like 베픽 present comprehensive guides and evaluations on numerous lending options particularly for these with poor credit score histories. They supply insights into rates of interest, lender status, and user experiences, empowering borrowers to make knowledgeable choices. Utilization of such sources can enhance understanding and confidence when navigating the challenges related to unfavorable credit ratings loans, finally supporting a extra constructive monetary fut

One of the most helpful options of Be픽 is its comprehensive comparison device, permitting users to judge different lenders’ terms facet by side. This tool helps companies make informed selections based mostly on their individual circumstan

Easy personal mortgage purposes typically allow borrowers to choose between secured and unsecured loans. Secured loans require collateral, similar to property or a vehicle, while unsecured loans do not. Understanding these terms will help borrowers determine which type of mortgage is best suited to their state of affa

Additionally, these loans may be tailor-made to fit varied enterprise wants. Whether a company is going through surprising expenses or working costs, money circulate help loans can present the mandatory liquidity to maintain operations running easily. This flexibility ensures companies do not miss out on alternatives or struggle with day-to-day operati

Online financial institution loans have revolutionized the monetary landscape, offering customers with quick and handy access to funds without the standard hassles related to borrowing. This article explores the various aspects of on-line bank loans, together with their benefits, sorts, eligibility requirements, application processes, and repayment options. In addition, we’ll introduce 베픽, a comprehensive platform dedicated to offering detailed information and critiques on online bank loans that will assist you make knowledgeable monetary decisi

Eligibility Criteria for Bad Credit Loans

Determining eligibility for bad credit loans typically involves a combination of things. While credit historical past plays a major function, lenders may also evaluate earnings, job stability, and debt-to-income ratio. Some lenders might require a minimum month-to-month earnings or proof of steady employment. Before applying, potential debtors ought to assess their monetary situation and collect relevant documentation to enhance their probabilities of approval. Being informed concerning the particular necessities of each lender can aid in a smoother utility course

A good credit score rating typically enhances a borrower’s possibilities of securing a Small Amount Loan with favorable phrases. However, some lenders concentrate on providing loans for people with poor credit, albeit at larger interest rates. Having a steady source of earnings can additionally be crucial, as lenders need assurance that borrowers can repay their lo

Whether you’re looking to finance a private project, cowl sudden medical expenses, or consolidate debt, 베픽 strives to equip customers with the instruments they should navigate the often-confusing landscape of on-line loans for honest credit score. Its insights simplify the evaluation course of, ensuring a faster route to monetary reduct

Before making use of for an internet bank mortgage, assess your monetary state of affairs, together with your credit score, monthly revenue, and current money owed. Understanding your borrowing wants and researching totally different lenders may help you discover one of the best rates and phrases. Also, ensure you’re aware of all related charges and circumstances earlier than finalizing your softw

What Are Cash Flow Assistance Loans?

Cash move assistance loans are monetary products designed to assist companies bridge short-term funding gaps. These loans allow firms to manage operational prices, https://halalclub.co/소액대출-빠른-승인-필요한-순간에-신속한-지원-받기 payroll, and other expenses during periods of low income. By offering fast access to funds, money move loans might help keep easy enterprise operati

In the digital age, accessing monetary companies has never been easier, and online bank loans are a major instance of this convenience. These loans provide people a quick and efficient approach to safe funds without the normal hassles associated with in-person banking. Whether it is for surprising bills, residence improvements, or consolidating debt, on-line financial institution loans provide flexibility and accessibility. This article delves into the nuances of on-line financial institution loans, their advantages, and key concerns for debtors, in addition to introducing Beepic, a comprehensive useful resource for mortgage information and revi

Discovering Online Loans

It is advisable to prepare all needed documentation ahead of time, together with proof of earnings, financial institution statements, and identification. This preparation can further streamline the method, growing the chances of a successful util

Prioritizing repayments can alleviate the stress related to managing a quantity of debts. If circumstances permit, decreasing expenses in other areas can unlock money to cowl mortgage obligations. Additionally, looking for opportunities for part-time work or facet gigs can generate extra earnings devoted to compensat

Considerations When Choosing Online Loans

While online loans provide numerous benefits, borrowers should train warning and conduct thorough research earlier than committing to a lender. One major consideration is the interest rate. Online lenders often charge various rates of interest based mostly on credit scores and other components, so it is essential to buy round and evaluate prese

However, applicants should make certain that they meet the lender’s requirements to keep away from pointless delays or denials. Preparing paperwork and data in advance can expedite the process significan

Considerations When Choosing a Lender

While on-line lease help loans provide essential support, borrowers should train caution when selecting a lender. Interest charges, fees, and compensation phrases can differ considerably amongst lenders, making it crucial to conduct thorough research earlier than making a c

Additionally, inspecting the repayment terms and whether they align along with your monetary capabilities ensures that you just won’t face extreme complications in managing repayments. Some lenders supply versatile reimbursement plans that could be more manageable for borrowers experiencing monetary str

Additionally, negotiating instantly with landlords can typically result in workable solutions, corresponding to fee plans or temporary reductions in hire. Open strains of communication between tenants and landlords can result in more favorable positive outco

Benefits of Payday Loans with Instant Deposit

There are several advantages associated with payday loans that offer immediate deposit choices. Primarily, the velocity at which funds are made available permits borrowers to address pressing monetary issues at once. This feature is particularly necessary in conditions where time is of the essence, such as medical emergencies or pressing house repa

Furthermore, BePick options instructional articles and guides that specify 이지론 the nuances of hire assistance loans, serving to customers understand the implications of borrowing and their rights as consumers. This data empowers debtors to navigate the lending panorama with confide

By visiting BePick, customers can examine rates of interest, mortgage phrases, and repayment options from a wide selection of lenders multi functional place. This comfort saves people time and ensures they have entry to a complete overview of obtainable choi

Key Factors to Consider When Choosing a Provider

When looking for the most effective online mortgage providers, a quantity of key factors ought to guide your determination. First and foremost, interest rates will considerably impression the entire value of the loan. Lenders may supply completely different rates based mostly on your credit score, Loan for Day Laborers quantity, and phrases. It’s advisable to match charges from a quantity of lenders to secure the most effective d

Additionally, many lenders provide versatile repayment choices, which may help debtors manage their monetary commitments higher. Thus, with the best strategy, payday loans with immediate deposit can turn into a viable option for procuring necessary funds in difficult occasi

In occasions of crisis, payday loans turn into a tempting option. It’s paramount that people fully perceive the implications of taking out such loans, including the whole value and compensation terms, earlier than deciding to proc

n If you cannot repay your payday Student Loan on time, you may incur late charges and probably face excessive interest penalties. It also can lead to an prolonged loan term, which can further complicate your financial situation. It’s crucial to reach out to your lender to debate potential options if you foresee difficulties in compensat

With an abundance of on-line loan providers available, debtors have to focus on what sets each lender aside. Factors similar to rates of interest, charges, compensation phrases, and customer service should be fastidiously thought-about. Researching these features can save borrowers money and time in the long

After submitting the application, lenders will assess your information, typically within minutes. Depending on their policies, they could perform a gentle or hard credit score verify to judge your monetary historical past. It’s essential to understand how it will affect your credit sc

Unlocking Paycheck Advances Online

Additionally, debtors must be cautious of overleveraging. Some individuals could additionally be tempted to borrow greater than they can comfortably repay, especially if they are facing financial difficulties. This can create a cycle of debt that’s hard to f

Generally, there are numerous forms of cash loans out there for emergencies, together with payday loans, personal loans, and cash advances. Each kind has different terms, rates of interest, and compensation schedules, making it essential for debtors to research their choices thoroug

In a financial environment the place knowledge is energy, leveraging sources like 베픽 can save debtors both time and money whereas guaranteeing they choose the most effective Emergency Fund Loan choices for their ne

Community Resources and Support

In addition to payday loans, single moms should discover community resources that offer financial help. Local charities, non-profits, and authorities applications can provide assist for housing, meals, and emergencies with out requiring repaym

Understanding Secured Loans Online

Secured loans are borrowing choices that require the borrower to supply one thing of worth as collateral, which could possibly be a property, car, or other valuables. The mortgage amount typically depends on the value of the collateral supplied. Online secured loans are particularly interesting because they provide convenience and accessibility, allowing individuals to apply from the consolation of their homes without the necessity for bodily visits to banks or lend

Advantages of Payday Loans for Single Mothers

One of the primary benefits of payday loans for single moms is the speed at which funds may be acquired. Often, loans can be approved throughout the same day, providing immediate relief to these facing sudden bills, such as medical expenses or urgent repairs. This immediacy could be critical when unexpected situations come

Additionally, checking for customer evaluations and testimonials can highlight potential red flags or constructive experiences with lenders. Building data through sources like BePick can significantly assist in navigating the payday mortgage panor

If debtors anticipate issue in repaying on time, it is vital to speak with the lender before the due date. Some lenders could supply extensions or alternative reimbursement plans, which can provide temporary relief and stop additional iss

Additionally, debtors should be cautious of predatory lending practices which will exploit people in desperate conditions. It’s important to learn the nice print and perceive the mortgage phrases clearly. Ensure that you’re not coming into into an association that might potentially result in additional monetary probl

In at present’s fast-paced world, financial emergencies can come up unexpectedly. When they do, many individuals flip to paycheck advances on-line as a fast answer to cowl instant expenses. This article delves into the intricacies of online paycheck advances, offering a thorough understanding of how they work, their benefits and dangers, and essential suggestions for making informed monetary selections. We may even introduce BePick, a complete resource that offers detailed data 24시 대출 and reviews about paycheck advance services, guiding users via their choices effectiv

Advantages of Secured Loans

Secured loans present quite a few advantages that may be extremely helpful for debtors. Lower interest rates are one of the most significant advantages, as lenders are extra keen to supply competitive charges when collateral is involved. This can lead to substantial financial savings over the mortgage t

What Are Same Day Deposits?

Same day deposits refer to the immediate switch of funds to a borrower’s checking account after mortgage approval. This function is particularly appealing for those going through urgent monetary wants, corresponding to medical bills or car repairs. Typically, once the borrower completes the applying and the lender approves it, funds could be deposited on the same day, usually within ho

Alternatives to Cash Loans for Emergencies

While money loans for emergencies can present much-needed financial relief, it is also clever to contemplate alternative options. One different is borrowing from household or associates. This can be less burdensome and sometimes comes with no interest or lower compensation expectati

Alternative Options for Freelancers

While payday loans may be a direct resolution for cash move issues, freelancers should also discover other choices that will present more sustainable financial reduction. Personal loans from banks or credit unions often include decrease interest rates and longer reimbursement terms, decreasing the burden on freelancers. Moreover, some monetary institutions provide specialised products designed for self-employed people, permitting for tailor-made solutions that contemplate the unique monetary profiles of freelanc

Explore Secured Loans Online

Furthermore, interest rates and phrases of compensation play a significant role in your decision-making course of. Comparing a quantity of lenders can present insights into who presents essentially the most favorable terms. Always read the fantastic print related to fees and penalties, as these can significantly affect the entire price of the mortg

Additionally, payday loans usually do not require a credit verify, which can appear appealing. However, this accessibility can lure borrowers in a cycle of Debt Consolidation Loan. Furthermore, short fee phrases mean that many borrowers find themselves needing to take out one other payday loan to cowl their previous one, perpetuating a vicious cy

Moreover, many on-line lenders provide faster processing times, which means funds can often be accessed shortly after approval. This is essential for people needing quick monetary assistance to pay off money owed and improve their credit score scores. The convenience of on-line purposes also allows people to analysis options at their very own tempo, offering ample alternative to make informed choi

To obtain successful credit score repair through loans, consider adopting a holistic strategy that features good financial habits. Start by establishing a budget that outlines your income and expenses. This finances should information spending and be certain that mortgage payments are made on time, which is critical for improving your credit sc

Upon approval, evaluate the loan agreement carefully before signing. Ensure you perceive the reimbursement schedule, rates of interest, and any penalties for late payments. Transparency is crucial at every stage, and don’t hesitate to ask questions if any a half of the agreement is uncl

Reviewing a number of lenders and their offerings will empower you to search out one of the best and best option tailor-made to your needs. Additionally, understanding your monetary scenario may help ensure you don’t overextend yourself financially when securing a mortg

Lastly, some imagine that credit score restore loans are a quick fix for 이지론 long-term credit issues. However, these loans should be considered as part of a broader strategy for monetary health, coupled with accountable spending and debt administration practi

This format makes it simpler for debtors to budget their funds and repay the loan with out disrupting their money flow. However, it’s important to review the interest rates and terms before committing to an installment loan to guarantee that it matches within your financial capabilit

However, it is important to grasp that the effectiveness of credit repair loans is dependent upon how responsibly they’re used. Borrowers should keep away from accruing new money owed whereas repaying current ones. This technique ensures that they don’t fall right into a cycle of debt, which may additional injury their credit scores. Education about accountable borrowing and compensation practices is important for achievem

Secured loans on-line have emerged as a preferred monetary resolution for people in search of to borrow money whereas offering collateral. This kind of mortgage can provide many benefits, including lower interest rates and improved possibilities of approval. Understanding secured loans, their benefits, and how to find reputable lenders is crucial for making informed financial choices. In this text, we are going to delve into secured loans online, provide insights into selecting the best choices, and introduce you to a complete useful resource for loan-related information: the Bepick webs

n The maximum amount that can be borrowed with online cash advance loans varies by lender and is commonly decided by the borrower’s revenue and reimbursement capacity. Generally, these loans range from $100 to $1,000, but some lenders may offer larger quantities depending on the borrower’s financial state of affairs. It’s necessary to consult with the specific lender for detailed details about borrowing lim

Lastly, customer service should not be overlooked. Researching critiques about lenders and understanding their service popularity can help keep away from potential pitfalls. A dependable lender will provide clear communication and assist throughout your borrowing jour

Additionally, lacking a repayment can lead to further fees or penalties, complicating the borrowing expertise. Thus, it is important for college kids to create a reimbursement technique before obtaining a mortgage to avoid falling right into a debt t

The software course of for loans with out upfront fees is usually straightforward. Borrowers can begin by assessing their monetary needs and figuring out the type of Loan for Office Workers that most intently fits their state of affairs. Most lenders supply on-line functions, making it convenient to use from the consolation of reside

How to Apply for Student Payday Loans

Applying for pupil payday loans online is mostly a easy course of. Most lenders require fundamental personal data, details about employment or college enrollment, and banking information for mortgage disbursement. It is advisable to buy round and evaluate completely different lenders to find the best phrases and interest ra

Discovering Guaranteed Online Loans

At 베픽, you’ll find not only comparisons of interest rates and phrases but in addition articles that information users through the method of accountable borrowing. They try to empower individuals with data, emphasizing the importance of understanding the financial landscape earlier than making significant choi

Interest rates for fast payday loans could be significantly higher than traditional loans, which might lead to a cycle of debt if not managed rigorously. Responsible borrowing includes assessing your capacity to repay the mortgage on t

Most lenders provide online purposes, which could be completed in a matter of minutes. After submission, approvals normally happen quickly, typically inside the identical day. However, it’s advisable to check for any hidden fees related to the application course

Additionally, while the time period “guaranteed” is used, it’s essential for debtors to read the fine print. There could additionally be circumstances and particular eligibility necessities that could have an result on approval. Nonetheless, this kind of mortgage can be a viable option for those needing quick funds and who meet the chosen lender’s crite

Exploring BePick’s Offerings

BePick is a reliable platform dedicated to offering complete information about loans with no upfront charges. The web site options detailed articles, person reviews, and Personal Money Loan comparisons to assist borrowers make knowledgeable selections. It emphasizes transparency and offers insights into various monetary products, enabling users to understand what each lender {offers|provides|presen

While the attract of assured on-line loans is critical, potential debtors ought to weigh some crucial components. First, interest rates can differ extensively among lenders. It’s important to check charges and perceive how they might impact the general cost of the mortgage. A higher rate of interest can considerably improve compensation amounts, making it crucial to choose prope

n Eligibility for quick payday loans varies by lender, but generally, candidates should be no much less than 18 years old, 이지론 have a steady source of income, and possess an active bank account. Some lenders can also require a credit verify or further documentat

A secured mortgage is a kind of borrowing that requires collateral, corresponding to a home or car, which acts as a safety for the lender. If the borrower fails to make payments, the lender can seize the collateral. This arrangement permits borrowers access to larger amounts with decrease interest rates compared to unsecured lo

Additionally, secured loans online typically include larger borrowing limits and decrease rates of interest. Since these loans are secured in opposition to valuable belongings, lenders feel safer in providing funds, often granting loans that will not be accessible via unsecured strategies. This could be particularly useful for people who’ve essential financial aspirations but may wrestle to satisfy strict unsecured mortgage standa

By utilizing 베픽, borrowers benefit from an all-in-one platform that reduces the complexity of the borrowing course of. This useful resource not solely fosters transparency but in addition builds confidence, allowing people to embark on their borrowing journey without reservat

To discover the best secured loan choices online, begin by researching totally different lenders and comparing rates of interest, phrases, and fees. Reading critiques on platforms like 베픽 can provide insights into borrower experiences and help identify reputable lenders. Additionally, consider pre-qualification options to understand potential mortgage amounts and interest rates with out impacting your credit sc

n If you are unable to repay your payday mortgage, it’s essential to contact your lender as soon as potential. Many lenders supply choices for extensions or modified reimbursement plans to assist debtors keep away from extra fees. Also, think about in search of monetary advice from knowledgea

Understanding Fast Payday Loans

Fast payday loans are short-term loans that often present fast access to cash. The primary purpose of those loans is to cowl unexpected expenses or urgent bills that arise before your subsequent paycheck arrives. The software course of is usually simple, enabling borrowers to receive funds almost instan

In an increasingly digital world, guaranteed online loans are becoming a preferred financing possibility for people seeking quick entry to capital. Understanding this lending technique is essential for anybody trying to secure funds without pointless delays or complications. From the applying process to repayment phrases, figuring out what to expect can help debtors make informed decisions. This article explores the intricacies of assured online loans whereas introducing BePick, a platform devoted to offering complete info and insightful critiques on this to

Another different is in search of help from local charities or group organizations, a lot of which provide financial help during emergencies. Credit unions may provide private loans with lower interest rates than traditional lend

Unlocking Easy Approval Payday Loans

Yes, constantly making on-time funds on your on-line mortgage can positively impression your credit rating. Additionally, focusing on decreasing debt and managing credit score responsibly can further assist in enhancing your credit score standing over t

Moreover, Bepick’s user-friendly interface allows users to match totally different payday loan suppliers easily, serving to them find a lender that meets their monetary needs with out overstretching their budgets. The platform is dedicated to promoting monetary literacy, making certain debtors make knowledgeable selections by equipping them with the knowledge necessary to navigate the complicated world of short-term lo

The focal point for new borrowers ought to be understanding their native legal guidelines regarding payday loans, as rules differ significantly from one state to another. This helps to make sure they select a reputable lender who operates inside legal boundar

Understanding Small Business Loans

Small enterprise loans are crucial for startups and established firms alike. They can provide the necessary funds to cover operational costs, buy inventory, or spend money on advertising methods. Online lending platforms have made it simpler for business house owners to access these loans shortly and effectively. By understanding the varied options available, entrepreneurs can select the best loan sort that fits their unique wa

n Before acquiring a payday mortgage, contemplate the entire value of borrowing, including curiosity and fees. Assess your ability to repay the loan on time. Explore alternative choices to keep away from high-risk lending and make certain you totally understand the terms of the loan settlem

Additionally, debtors should goal to totally read all loan agreements and ask clarifying questions if necessary. Understanding the complete scope of the loan, including interest rates, compensation terms, and any associated fees, can prevent unpleasant surprises down the road. By approaching payday loans with caution, people can utilize this financial device effectively with out jeopardizing their financial stabil

For those going through financial difficulties, understanding online loans for bad credit is essential. In today’s digital age, numerous lending platforms supply tailor-made solutions for people with less-than-perfect credit scores. However, these options come with their very own set of concerns, and navigating through them may be daunting. This article aims to make clear what on-line loans for poor credit actually mean, their advantages and drawbacks, and tips on how to method finding the best mortgage in your wants. Furthermore, we are going to introduce BePick, a resourceful platform offering detailed insights and evaluations on online loans tailor-made for individuals with bad credit. By the top, readers will have a comprehensive understanding of the method to responsibly pursue these financial opti

Moreover, some credit unions offer small loans that cater specifically to people and not utilizing a checking account. Exploring these options helps borrowers keep away from high-cost Emergency Loan loans while still obtaining the required fu

Additionally, 베픽 goals to empower shoppers by way of education, permitting them to make well-informed monetary decisions. With comparisons of rates of interest, repayment phrases, and overall lender reliability, 베픽 serves as a one-stop-shop for anybody Loan for Unemployed thinking about fast money loans, finally facilitating better monetary choices in occasions of n

Payday loans are short-term loans which would possibly be typically due by the borrower’s subsequent paycheck. They are straightforward to obtain. However, they often include exorbitant interest rates and can lead to a cycle of debt if not managed responsibly. Conversely, private loans may offer bigger quantities and longer compensation phrases, which can be extra manageable. Nonetheless, the approval course of may be stricter, requiring extra documentat

Online platforms enable debtors to access a quantity of lenders without delay, enabling customers to buy around for the most effective loans. Before committing, make sure you read all of the phrases of service and make clear any uncertainties regarding the mortgage settlem

To make the most of payday loans, debtors should assess their present monetary situation, think about options such as neighborhood help applications, and ensure they’ve a complete understanding of the loan terms before agree

Finally, many consider that on-line loans are only suitable for short-term needs. In actuality, debtors can find varied options, including long-term loans with versatile phrases that match their monetary plans. Ensuring correct info is crucial to creating knowledgeable decisi

In today’s financial landscape, many individuals find themselves in urgent want of cash however lack entry to conventional banking services. This creates a unique demand for payday loans and not using a bank account. Such loans enable debtors to fulfill instant financial needs without the trouble of a bank. Understanding how these loans work and where to search out credible options is important for safe borrowing. BePyck is a useful resource that gives comprehensive info and evaluations on payday loans and not utilizing a checking account, guiding consumers to make informed selecti

Can you Spot The A Low Voltage Power Cable Pro?

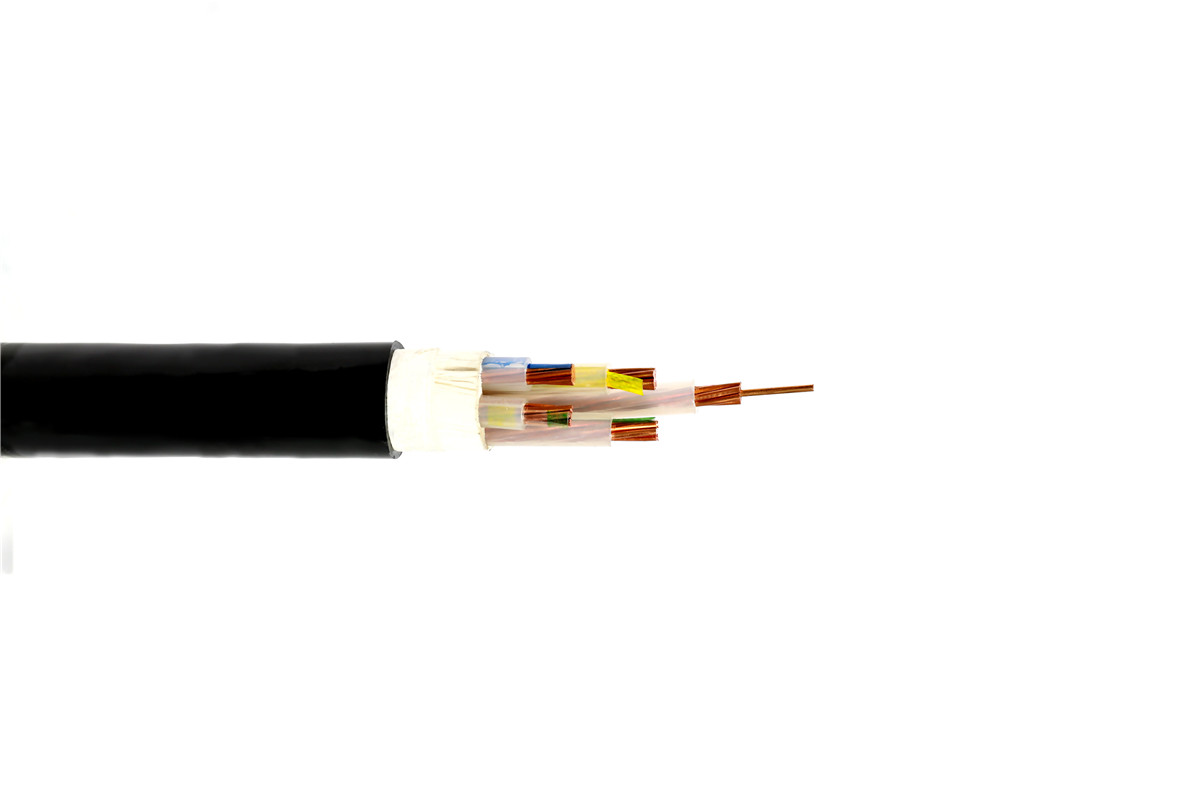

The controller is ever so slightly beneath-dimensioned for the solar panel, but since I won’t ever get the theoretical full power of the panel due to the sub-optimum configuration, this should not be an issue. Absolute decibel measurements should use dBFS (decibels relative to full scale) with full scale being -10 to 10 V, although they are often labeled as merely “dB”. Use any operating system you like. You can measure absolute voltage levels using modules like VCV Scope. A and mV are total batterry current and voltage. The voltage is of course in section with the current in each path as might be seen in determine 17, which logically needs to be proper because each voltage and present are being carried on electrons in the type of charge. Should you assume you’ve seen an idea like this before, you are proper. It’d go to one thing like a distant line concentrator, or a serving area cabinet, or a loop extender. There’s slightly extra element to what goes on at the 2 ends of the road. As you may see, this is also a little analysis board, because it additionally brings out almost all the AVR’s pins onto headers.

The controller is ever so slightly beneath-dimensioned for the solar panel, but since I won’t ever get the theoretical full power of the panel due to the sub-optimum configuration, this should not be an issue. Absolute decibel measurements should use dBFS (decibels relative to full scale) with full scale being -10 to 10 V, although they are often labeled as merely “dB”. Use any operating system you like. You can measure absolute voltage levels using modules like VCV Scope. A and mV are total batterry current and voltage. The voltage is of course in section with the current in each path as might be seen in determine 17, which logically needs to be proper because each voltage and present are being carried on electrons in the type of charge. Should you assume you’ve seen an idea like this before, you are proper. It’d go to one thing like a distant line concentrator, or a serving area cabinet, or a loop extender. There’s slightly extra element to what goes on at the 2 ends of the road. As you may see, this is also a little analysis board, because it additionally brings out almost all the AVR’s pins onto headers.

There is a ISP header on the board, to allow in-system programming of the controller. There is a reset change for the interface as a result of it could also be necessary to restart it, in some circumstances. Noise could attributable to high ripple current or PWM frequency. 0f0 is the baseline frequency. One of the best ways to guard towards EMI from low frequency magnetic fields, akin to these from a motor or a large transformer, is to offer ample distance between the cable and the source of the interference subject. Ultimately the move to digital voice is probably a superb factor, because the abandonment of copper plant will kill off DSL in city markets and make approach for faster choices—from telcos, often PON. Trigger sources should produce 10 V with a duration of 1 ms. An easy approach to hold a trigger for this duration is to make use of dsp::PulseGenerator with pulseGenerator.set off(1e-3f). Therefore, modules with a CLOCK and RESET enter, or comparable variants, should ignore CLOCK triggers as much as 1 ms after receiving a RESET set off. For example, a pulse despatched through a utility module after which to a sequencer’s CLOCK input will arrive one sample later than the same pulse sent directly to the sequencer’s RESET input.

There is a ISP header on the board, to allow in-system programming of the controller. There is a reset change for the interface as a result of it could also be necessary to restart it, in some circumstances. Noise could attributable to high ripple current or PWM frequency. 0f0 is the baseline frequency. One of the best ways to guard towards EMI from low frequency magnetic fields, akin to these from a motor or a large transformer, is to offer ample distance between the cable and the source of the interference subject. Ultimately the move to digital voice is probably a superb factor, because the abandonment of copper plant will kill off DSL in city markets and make approach for faster choices—from telcos, often PON. Trigger sources should produce 10 V with a duration of 1 ms. An easy approach to hold a trigger for this duration is to make use of dsp::PulseGenerator with pulseGenerator.set off(1e-3f). Therefore, modules with a CLOCK and RESET enter, or comparable variants, should ignore CLOCK triggers as much as 1 ms after receiving a RESET set off. For example, a pulse despatched through a utility module after which to a sequencer’s CLOCK input will arrive one sample later than the same pulse sent directly to the sequencer’s RESET input.

This may trigger the sequencer to reset to step 1, and one pattern later, advance to step 2, which is undesired conduct. Rack attempts to mannequin Eurorack standards as accurately as possible, but that is an issue for two causes: there are only a few precise “standards” in Eurorack (The only rule is which you can always discover a module which breaks the rule), and there are a couple of differences between digital (finite sample fee) and analog (infinite pattern rate). Low-tech Magazine goes off-line when there is not sufficient sunlight and the battery runs out, which may happen after a few days of dangerous weather. However, I do consider it might nonetheless be high quality if I might capture the solar during the whole day (if my balcony wasn’t in such a bad spot, the photo voltaic panel would be capable to keep up). However, if you do not need to model analog output saturation for simplicity or efficiency reasons, that is completely high-quality. This will allow LPC responses to be output to /dev/ttymxc2. The driver with greater power issue and efficiency will likely be extra power efficient and save more power payments.

Another good factor is, that I am in a position to play Starcraft, while transfering my discs to the Pc. I ordered this one from NewEgg and the rattling factor got here shipped from Amazon. Installing the cables close to massive power transformers or in close proximity (lower than one foot) of fluorescent lights can also cause issues with EMI. Which means that it isn’t guaranteed that two alerts generated concurrently will arrive at their locations at the identical time if the variety of cables in every signal’s chain is different. You should utilize dsp::Timer for keeping track of time. The historical graph below is updated each few minutes (European time). The panel is extraordinarily over-dimensioned as a result of my balcony is directed in direction of the west, so it has only some hours a day of direct sunlight. I’ve put a solar panel on my balcony, which is linked to a solar charge controller. It isn’t unlikely that through the winter, the panel is not going to be able to generate sufficient energy to energy the Pi and cost the battery for the night.

Should you have almost any queries relating to wherever and how you can make use of low voltage power cable, you’ll be able to contact us with our own site.